by George Rasley

We’ve told you before about Stephen Moore’s Committee to Unleash Prosperity and his must-read Hotline but the Friday, December 10 edition was a Pulitzer Prize winner, or would be if conservatives ever got Pulitzer Prizes. You can read the entire newsletter through this link and we highly recommend you do so, because in one edition it pretty well destroys the entire Biden Democrat agenda.

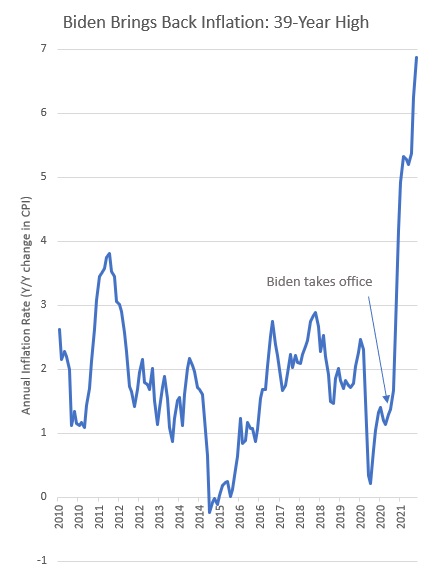

The lead article shows the effects of Biden’s inflation disaster in one chart. And Steve Moore explains “inflation isn’t going away. No, it isn’t transitory. And, sorry, no, CNN, it isn’t good for you!”

The lead article shows the effects of Biden’s inflation disaster in one chart. And Steve Moore explains “inflation isn’t going away. No, it isn’t transitory. And, sorry, no, CNN, it isn’t good for you!”

The chart shows the Biden inflation effect. Since this time last year inflation is up roughly 7%. The November pace on an annualized basis is close to 10. Half of Americans were born after 1980, so never in their lifetimes have they experienced this kind of sticker shock.

Adding another $4 trillion of government spending to this bonfire of inflation would be catastrophically stupid, so, of course, the Biden White House wants to move full speed ahead with Build Back Better. This is a very scary gang, said Mr. Moore.

Of course, Democrats believe that they can make inflation go away by sending all their mouthpieces out to happy talk the networks and liberal influencers, as Treasury Secretary Janet Yellen has been doing.

A month ago, Yellen said U.S. inflation will prove “transitory,” while acknowledging it will take longer for the pace of price gains to return to normal. “I believe it’s transitory, but I don’t mean to suggest these pressures will disappear in the next month or two,” Yellen said in an interview on CBS Evening News with Norah O’Donnell.

Yellen attributed the price spikes in many goods to the “huge disruption” from the Covid-19 pandemic to global supply chains, an effect that would slowly dissipate.

“There’s no reason for consumers to panic over the absence of goods they’re going to want to acquire at Christmas,” she added.

However, even liberal economist Paul Krugman, writing for The New York Times, appeared to disagree with Secretary Yellen:

But even if you try to adjust for special circumstances, underlying inflation appears to be running high by recent standards, maybe around 4 percent instead of the 2 percent that is the Fed’s target and has been the norm since the mid-1990s. This in turn reflects an economy in which spending is more or less back to the pre-pandemic trend but production is constrained both by bottlenecks and by the withdrawal of several million Americans from the labor force. (Emphasis ours.)

Though gross pay has increased 4.8% over the past year, real average hourly earnings accounting for inflation declined another 0.4% for November and are down 1.9% for the 12-month period, the Labor Department said in a separate release.

Meaning poorer people took the biggest hit.

And, as Jeff Cox, Finance Editor of CNBC noted, surging prices for food, energy and shelter accounted for much of the increase in inflation:

Energy prices have risen 33.3% since November 2020, including a 3.5% surge in November. Gasoline alone is up 58.1%.

Food prices have jumped 6.1% over the year, while used car and truck prices, a major contributor to the inflation burst, are up 31.4%, following a 2.5% increase last month.

Shelter costs, which comprise about one-third of the CPI, increased 3.8% on the year, the highest since 2007 as the housing crisis accelerated.

Apparel costs also were notably higher for the month, rising 1.3% for the month and 5% for the year, ahead of the holiday shopping season.

What’s more, there was no good news in the numbers for Democrats looking to segment out something positive: Excluding food and energy prices, so-called core CPI was up 0.5% for the month and 4.9% from a year ago, which itself was the sharpest pickup since mid-1991.

None of this has been lost on voters, despite the best efforts of the Biden White House to dragoon reporters into spinning the bad economic news into good news.

The New York Post reports a majority of Americans disapprove of how President Biden is handling the economic recovery, inflation, immigration and crime — with his only positive numbers coming from his response to the coronavirus pandemic and his infrastructure plan, according to a poll released Sunday.

Sixty-nine percent of Americans give Biden a thumbs down on his handling of inflation with only 28 percent approving, while 57 percent disapprove of how he has guided the economic recovery, an ABC News/Ipsos poll shows.

Biden, however, appears to be impervious to economic facts, and on Friday argued Congress should pass his $2 trillion social and environmental spending bill.

“For anyone who, like me, is concerned about costs facing American families, passing [the Build Back Better Act] is the most immediate and direct step we can take to deliver,” Biden said in a statement. Biden claimed that “the challenge of prices underscores the importance that Congress move without delay to pass my Build Back Better plan, which lowers how much families pay for health care, prescription drugs, childcare, and more.”

None of that is true, as Steve Moore demonstrated in Friday’s must-read Committee to Unleash Prosperity Hotline.

Your best protection against exacerbating the Biden inflation disaster is to demand your Senators vote NO on the $2 trillion so-called Build Back Better bill. The toll-free Capitol Switchboard (1-866-220-0044), call your Senators and demand that they vote NO on Biden’s inflationary disaster, the Build Back Better bill.

– – –

George Rasley is the Editor of ConservativeHQ.

Photo “President Joe Biden” by The White House.

The Democrat winning formula for years used to be TAX, TAX, TAX, SPEND, SPEND, SPEND, ELECT, ELECT, ELECT. Probably not now. Inflation is better understood today by economists–and yes, economists do understand inflation–than they did decades ago. When ‘Brandon’ and his crowd deny the effects of ‘heaped up mounds’ of trillions of dollars of Federal expenditures THEY ARE LYING TO YOU!

The late Milton Friedman, Nobel Prize winning conservative Republican economist in his excellent 1992 book, MONEY MISCHIEF: Episodes in Monetary History, clearly explains all of this. (The book is excellent for those, like me, who only took the introductory courses in college and who are not professional economists.) I commend this book to your reading (if you can still get it). Maybe your local library or college library will have a copy that you can read. It would be an excellent Christmas gift for someone you love. It took the Reagan Administration years to reverse the adverse effects of the hyper-inflation created by the Carter Administration Federal spending when home loan interest rates rose to 16% and more. Try paying for a house when your adjusted rate home loan interest rate is 16% or more.